In everyday usage risk is often used synonymously with probability of a loss or threat. The risk is a concept which relates to human expectations.

There Are Many Different Types Of Life Insurance There Are Two Primary Types Of Life Insurance Whole L Insurance Quotes Financial Advisory Financial Advisors

Financial risk includes those risks whose outcomes can be measured in monetary terms.

. Financial risk involves the simultaneous existence of three important elements in a risky situation. Broadly speaking there are two main categories of risk. You need the security of insurance.

When an individual is personally affected by the risk involved this is known as personal risk. And you need both in life. For example if an all-risks homeowners policy does not expressly exclude.

Insurable risks are those risks for which insurance is provided to alleviate the effect of loss. Fundamental risks are the risks mostly emanating from nature. Pure risk and speculative risk.

The risk can be of many types but it revolves around two main factors. Fundamental risks are the risks mostly emanating from nature. The two main types of auto insurance are property damage coverage and bodily injury coverage.

Risk is everywhere. Operational risk addresses your businesss day-to-day dealings. Financial risks can be measured in monetary terms.

If you needed more information on the other commercial property insurance types or would like a free custom commercial property insurance quote please do not hesitate to give us a call at 916 313 6100. The first step towards arrested the risk or fear of risk is to identify the risk. Coverage may vary depending on whether the damage is to you or your property or someone else or their property.

There are both insurable and non-insurable risks. Get a Free Insurance Quote Today. There are mainly 2 types of risks in insurance that can be covered by insurance companies.

Hence it important to know the nature of the risk. But how to identify it unless it is known what type of risk should looked into. Insurance companies cover risks that are classified under pure types of risks in insurance.

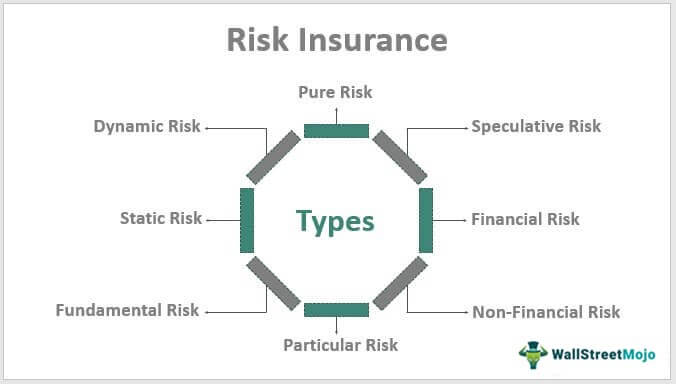

3 Types of Risk in Insurance are Financial and Non-Financial Risks Pure and Speculative Risks and Fundamental and Particular Risks. Systematic risk is the market uncertainty of an investment meaning that it represents external factors that impact all or many companies in an industry or group. There is a wide range of insurance products that can be used.

That means handling equipment workers customers and your overall product or service. By insuring tangible assets. These risks are analyzed and the premium plan is made according to each of them.

These are just two of the many forms of commercial property insurance. There are different types of risks in insurance. Personal risk is the basis behind a wide variety of insurance types including unemployment health homeowners and renters insurance.

This is also where policyholders find the most ambiguity in their policies. A primary insurer purchases facultative reinsurance to cover a single riskor a group of risksheld in the primary insurers book of business. Such risks are accidental in nature.

3 Types of Risk in Insurance. Types of Risk. The assessment of loss can be carried out and thus proper monetary value associated with it can be given in respect of such losses.

Get Auto Insurance From State Farm. Speculative risks are not insurable. The different types of risk in insurance are as follows.

When you drive your car to work when you visit a new country when you ride your bike to a nearby shop when theres a new bug going around in town. Auto insurance coverage can be divided into two main categories. Types of Risk in Insurance.

Relative risk compares the volatility of an investment to a common standard. All risks is a type of insurance coverage that automatically covers any risk that the contract does not explicitly omit. So a stock mutual fund with a relative risk score of 110 has been roughly 10 more volatile than the SP 500 over the past three years whereas a fund with a relative risk score of 095 has been roughly 5 less volatile.

Financial risk is such risk whose monetary value of a loss on the happening of a certain event can be measured. Facultative reinsurance mostly covers a single transaction and is a one-time contract with the. It denotes a potential negative impact on an asset or some characteristic of value that may arise from some present process or some future event.

Some types of insurance are required while others are optional. 15 minutes agoThe study population includes males and females of the adult population 18 years who 1 have an active membership in the involved health insurance company 2 show elevated risk factors or manifested diseases for at least two of the four selected diagnoses 3 show constant medication during the previous 3 months and 4 are currently. A that someone is adversely affected by the happening of an event b the assets or income is likely to be exposed to a financial loss from the occurrence of.

Under the two major risks other types of risks branch out. Pure risks are a loss only or at best a break-even situation. Fast Free Quotes Are Available Online.

These are various types of risks in insurance. Financial and Non Financial risk. Here we list down all the different kinds of reinsurances available.

There are two broad types of insurance. Types of Risk in Insurance. Pure risks are a loss only or at best a break-even situation.

For a better understanding of these risks we should dig deeper and. For stocks that standard is the SP 500 index. Ad State Farm Offers Many Coverage Options.

In this type of risk loss of a personthing is compensated by paying money to the person after proper assessment of loss. Risks in insurance. 3 Types of Risk in Insurance are Financial and Non-Financial Risks Pure and Speculative Risks and Fundamental and Particular Risks.

Financial risks can be measured in monetary terms.

Over 40 Risk Matrix Diagrams Types Icons Severity Ppt Template Risk Matrix Matrix Risk Analysis

Types Of People Who Have Insurance Online Insurance Insurance Comparison Best Insurance

Is Auto Insurance Required By Law Car Insurance Liability Insurance Auto Insurance Quotes

Buy Motor Liability Only Insurance With Hassle Free Claim Settlement And Claims Support Https Www Bajaj Life Insurance Facts Car Insurance Insurance Policy

Steps To Health And Safety Strategy Plan In An Enterprise Riskcom Safety Management System Health And Safety Business Risk

Enter All These Gifts Cards For The Best Chance Of Winning Life And Health Insurance Whole Life Insurance Life Insurance Marketing

Saving Vs Investing Which Is Better Investment Quotes Insurance Investments Investing

How Can You Tell If You Have The Best Insurance Available Best Insurance Insurance Agent Infographic

Insurance Concept Businessman Writing Insurance Concept On Screen Ad Concept Insur Best Health Insurance Health Insurance Plans Travel Insurance Quotes

Important Facts You Should Know Important Facts Facts Insurance Policy

Best Auto Insurance In Montana

Life Insurance Overview Types How To Buy Life Insurance Companies Benefits Of Life Insurance Life Insurance Companies Life Insurance Sales

Safety And Risk Management Diagram Risk Management Project Management Books Powerpoint Charts

Esurance Motorcycle Insurance Quote

10 Facts About Life Insurance Life Insurance Marketing Life Insurance Facts Life Insurance Quotes

Detection Risk Business Risk Detection Risk

Insurance Underwriters Meaning Roles Common Factors Types And More Underwriting Casualty Insurance Property And Casualty

Risk Insurance Definition Top 8 Types Of Risks In Insurance

Here Is Everything You Need To Know About Money Market Accounts Https Www Youtube Com Watch V J5mcdkh3 Money Market Account Money Market Managing Your Money